omaha nebraska vehicle sales tax

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022. Nebraska vehicle title and registration resources.

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

This is the total of state county and city sales tax rates.

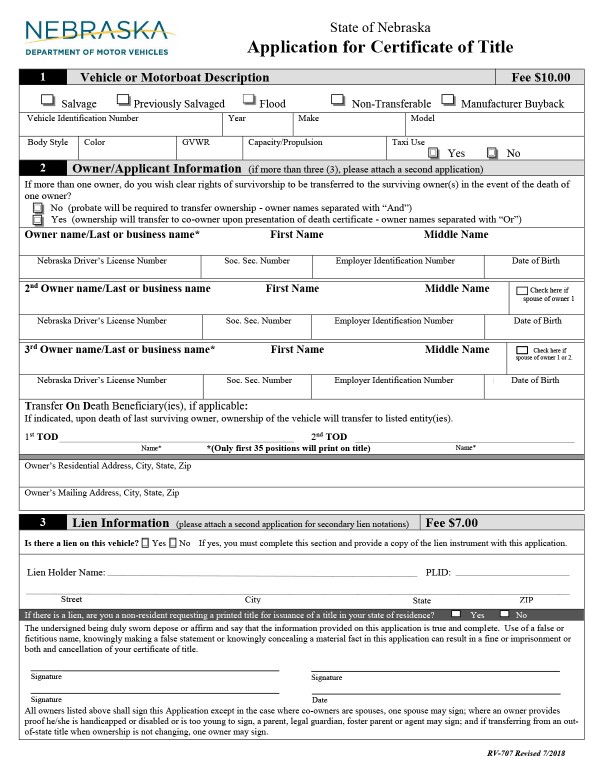

. Vehicles in Nebraska are registered in the county where the vehicle has situs which means in the county where the vehicle is housed majority of the time. - 2000 Total Due. Vehicle Title Registration.

Campos Tax Services Edinburg Tx. You can find these fees further down on the page. Omaha Ne Sales Tax Calculator.

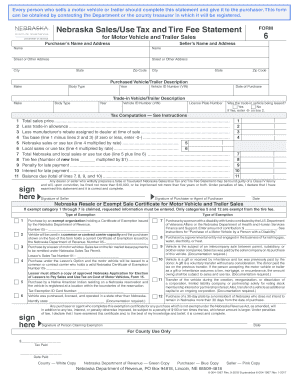

Or Form 6XMB Amended Nebraska Sales and Use Tax Statement for Motorboat Sales. The tax exemption on menstrual products passed the House 94. The Omaha sales tax rate is.

State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger. Repair labor on motor vehicles. The County sales tax rate is.

The sales tax is still due from the customer even if the deal certificate covers the full price of the article redeemed. Nebraska has a 55 statewide sales tax rate but also has 295. Nebraska City 20 75 075 16.

You can find more tax rates and. A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6 as a trade-in must be titled in the name of the purchaser. The percentage of the Base Tax applied is reduced as the vehicle ages.

The legislation also establishes a second sales-tax-free week on clothing and footwear valued under 100 per item beginning April 10. James said he supports a repeal of the 10-cent-per-gallon gas increase approved in 2019 as well as a repeal of the states sales tax on food and business privilege tax. The Nebraska state sales and use tax rate is 55 055.

See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently. Once the MSRP of the vehicle is established a Base Tax set in Nebraska motor vehicle statutes is assigned to the specific MSRP range and motor vehicle tax is then assessed. Nebraska has a 55 statewide sales tax rate but also has 295 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 055 on top of the state tax.

Speak Victory Over Your Life Scripture. A 5 percent sales tax is imposed by Nebraska on all sales and use. There are no changes to local sales and use tax rates that are effective July 1 2022.

Creightons fight was on full display in Jays win over San Diego State Nebraska parts ways with. How Much Do Car Plates Cost In Nebraska. Crash kills Omaha driver seen racing other vehicle near.

Department of Revenue Current Local Sales and Use Tax Rates Vehicles Towed from Private PropertyVehicles Left Unattended on Private Property. The sales tax rate for omaha was updated for the 2020 tax year this is the current sales tax rate we are using in the omaha nebraska sales tax comparison calculator for 202223. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

This example vehicle is a passenger truck registered in Omaha purchased for 33585. Both plans would reduce the 7 sales tax on groceries. Groceries are exempt from the omaha and nebraska state sales taxes The nebraska state sales and use tax rate is 55.

Newly purchased vehicles must be registered and sales tax paid within 30 days of the date of purchase. The minimum combined 2022 sales tax rate for Omaha Nebraska is. The MSRP on a vehicle is set by the manufacturer and can never be changed.

The Nebraska sales tax rate is currently. Crash kills Omaha driver seen racing other vehicle near Millard. 4 rows The current total local sales tax rate in Omaha NE is 7000.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Form 6MB Nebraska Sales and Use Tax Statement for Motorboat Sales.

The December 2020 total. Sweet Life Quotes Images. The Senate plan includes one-time income tax rebates of 100 to 1000.

Omaha nebraska vs sanibel florida. Repair labor involved in restoring the original form and condition of a motor vehicle or replacing a component part in a motor vehicle trailer or semitrailer. Crash kills Omaha driver seen racing other vehicle near Millard Shatel.

Greater Omaha Chamber of Commerce UNO. Dakota County and Gage County each impose a tax rate of 05. Please note that the total amount due from the customer consists only of the tax calculated and collected by the clothing store on this transaction.

Since February the sales tax on all menstrual products in the state has been removed. A fillable Form 6 Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales is now available on DORs website. Each new duplicate or replacement plate reclassified to the Highway Trust Fund will incur a fee of 30.

Repair labor performed on any item the sale of which is not subject to sales tax.

How To Get A Resale Certificate In Nebraska Startingyourbusiness Com

Sales Tax On Cars And Vehicles In Nebraska

Superlative 1927 Sinclair Aviation Gasoline Restored American Visible Gas Pump Model 2487 Barrett Jackson Auction Company Vintage Gas Pumps Gas Pumps Gas

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Nebraska Dmv Forms Etags Vehicle Registration Title Services Driven By Technology

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Slash 4x4 Water Action Slash 4x4 Traxxas Slash 4x4 Traxxas Slash

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Nebraska Sales Tax Small Business Guide Truic

Latest Information On Dmv Services Nebraska Department Of Motor Vehicles

Market Exterior Design On Behance Commercial Design Exterior Facade Architecture Industrial Architecture

Contact Us Nebraska Department Of Revenue

Jeepxchange Iowa Photo Sharing Lose Something

Welcome To Nebraska Nebraska State Signs Life Is Good

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller